Developing research methods to understand Commercial Bank clients when access and time with them are limited.

Capital One Commercial Bank provides services and tools for treasury teams in large businesses to understand and manage their money—collecting, sending money, borrowing, investing, and understanding their money.

Commercial Bank users have many similar needs as consumers, which are ultimately the ability to understand and manage their money (at their job). However, there were some additional complexities to consider. Unlike consumer banking, Commercial Banking makes revenue from large deposits with large corporations, and thus has a smaller customer base.

For our various ongoing product initiatives in the Commercial Bank, we all had a common broader question around who our clients are that we serve in the Commercial Bank. Given that we have a smaller customer base and because our customers tended to be leaders at large corporations or those who had very specific job functions, we had limited access to clients in general to interview.

How might we understand our clients that we service in the Commercial Bank when our time with and access to them are limited?

Depending on the size of the company, the title or roles of our users can vary—the CFO or Treasurer of a company might be the decision maker who is our customer, but the end users of the tools that we design are those could be more operational, such as treasury managers, accounts receivables, payables clerks.

There were many opportunities to improve the experience for all aspects of a treasury team's job, but the first focus area we wanted to solve problems in was around enabling our users to gain insights and information around their finances and their cash positioning.

If we can't find time with our clients, we could also talk with people who are in similar roles and industries as our clients, but aren't currently our customer. Our research coordinators helped us find and screen proxy clients to interview for various projects, as well as keep track of clients who would be good to talk to again for future projects.

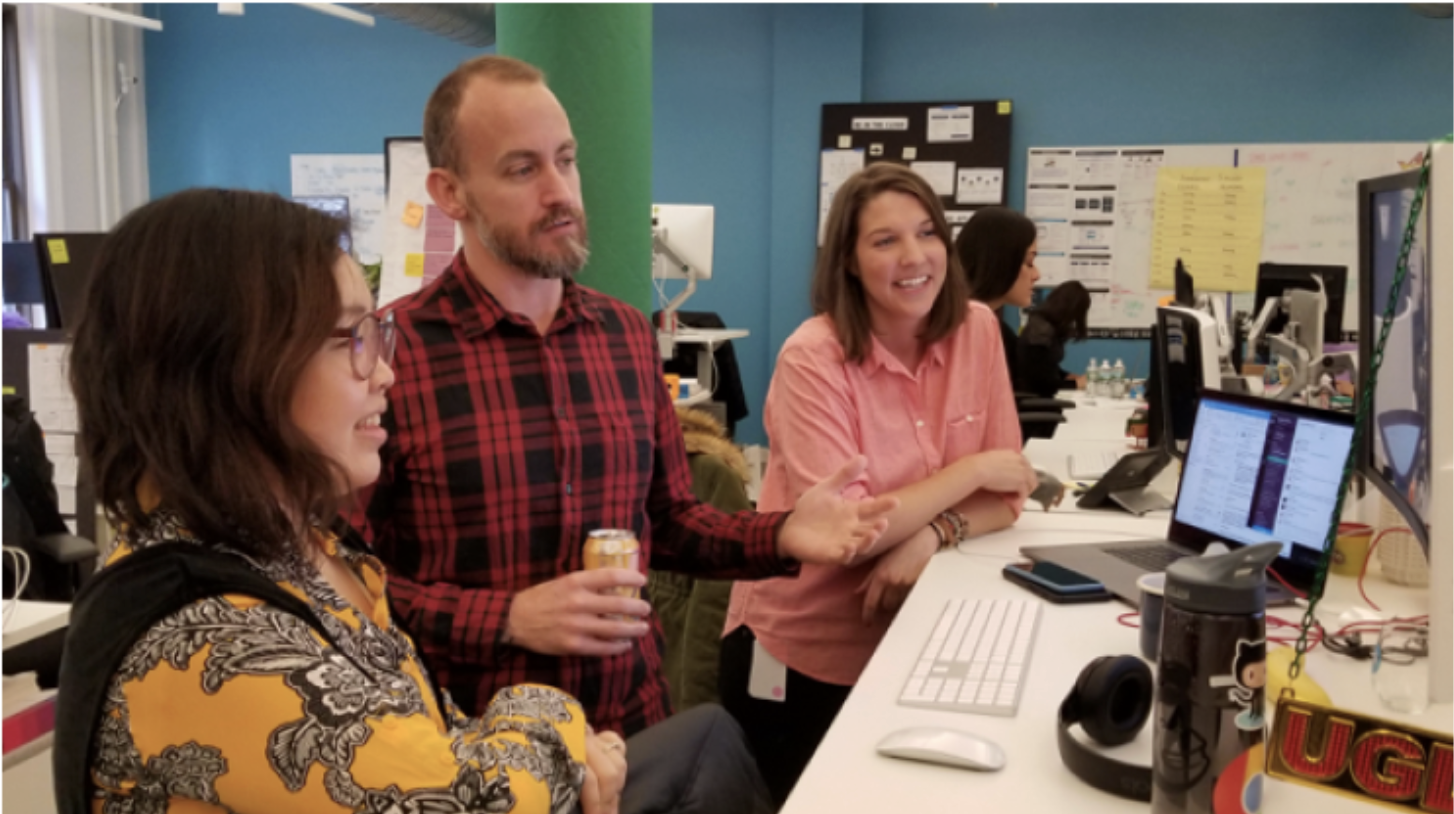

Since commercial banking is a relationship-based business, we have Client Relationship Managers (CRMs) and Sales teams who are the front-line associates who interface with our clients on a day to day basis. We started to hold mixers with our CRMs (Client Relationship Managers) and Sales to evangelize the importance of design research and the value it could bring to them. Mixers helped us form partnerships with them and provided a forum for sharing updates on what will be improved next in our products so that CR/Sales can help their clients better. This in turn encouraged them to want to make introductions between our clients and design researchers so we can better understand what our clients need.

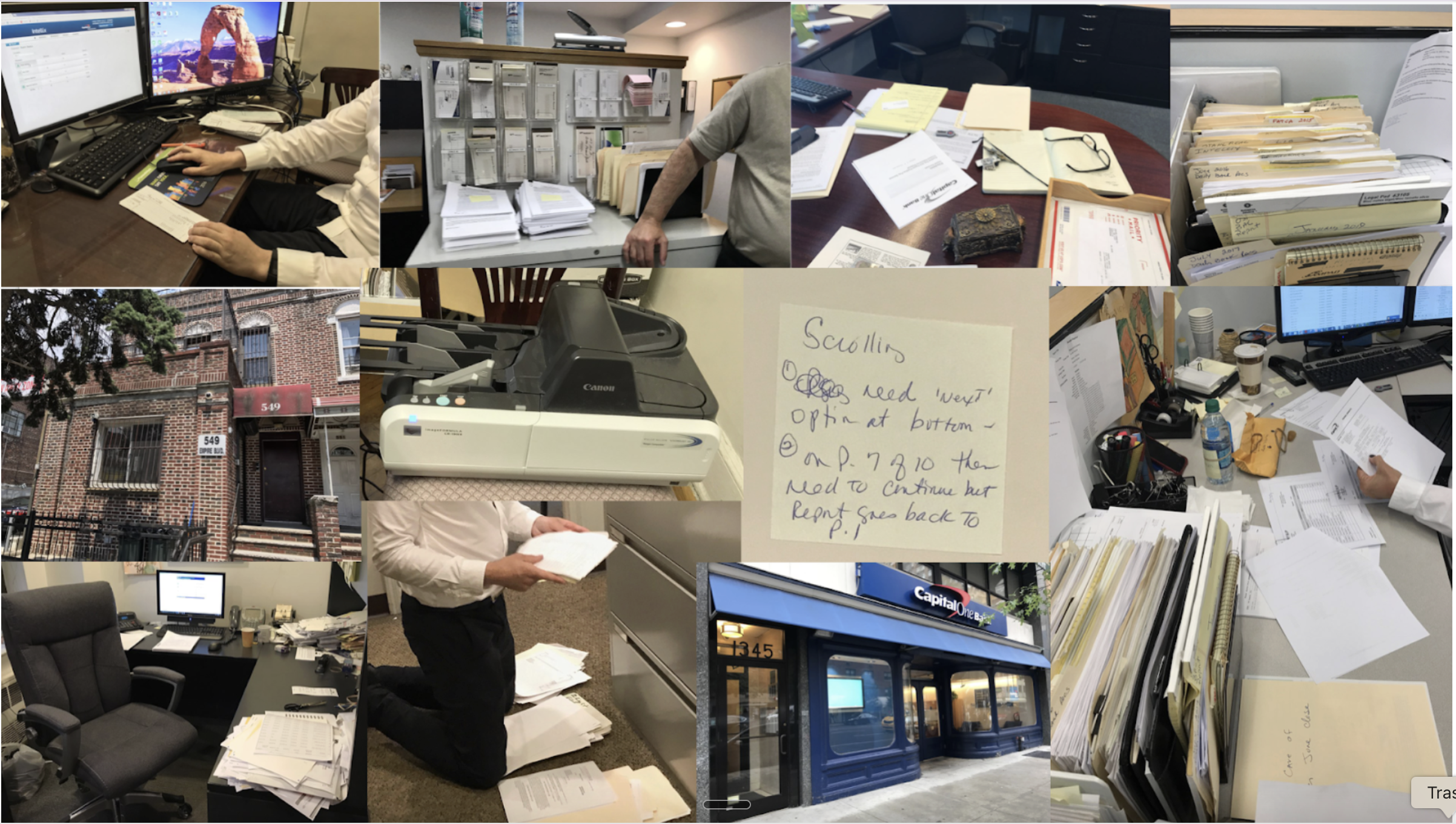

When possible, we would conduct field studies by visiting our clients' offices to get a feel for their environment, the flow of their day-to-day responsibilities, and how they interact with our tools.

Snapshot of clients' offices and artifacts that we saw from our field studies. A lot of their processes are still very manual and paper-heavy.

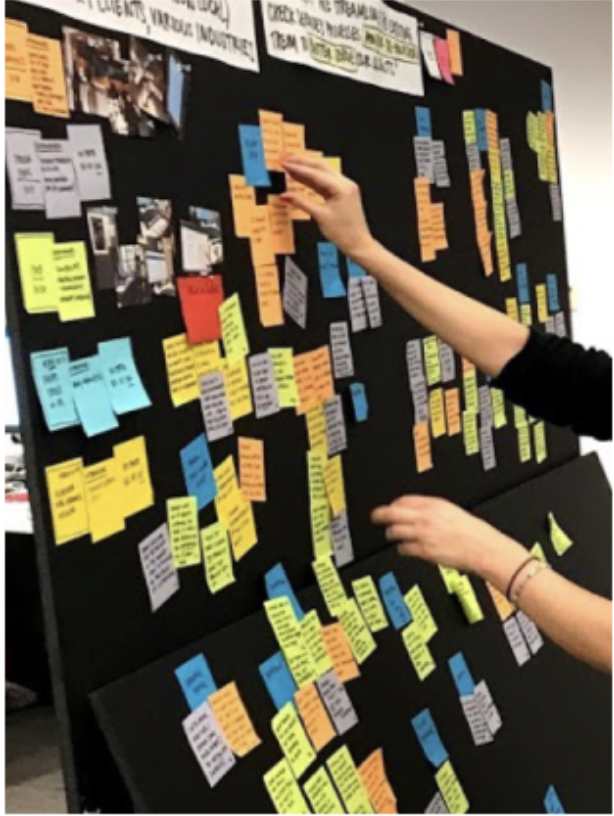

When we had some extended time with clients or proxy clients, we even started to organize and facilitate co-creation workshops with our clients to maximize our time with them to understand their needs. This also worked great for having concrete takeaways at the end of each session to improve processes and solve specific problems quickly.

Co-creation with a client who used the Lockbox service—we facilitated a workshop to try to understand their process overlapping with Capital One's process and where the pain points and gaps were happening.

The Commercial design team worked together across multiple lines of business and projects to create a shared understanding of who our clients are through client and proxy client research. After each interview or workshop, the project team or even a broader team of design researchers got together to debrief and synthesize findings.

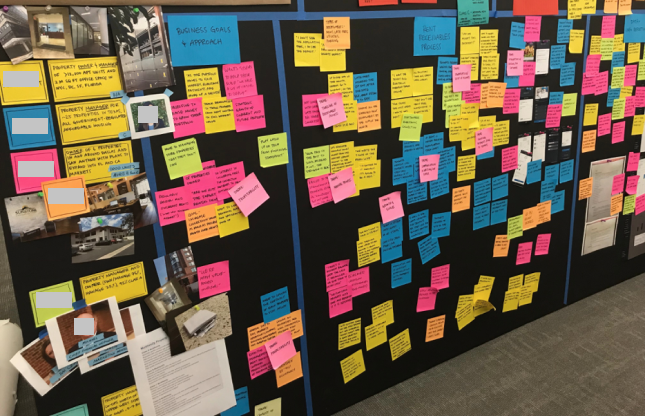

Synthesizing findings from several different interviews via affinity mapping (each color represents a client). We used synthesis from several different research studies to gain a more holistic understanding of our users and their needs.

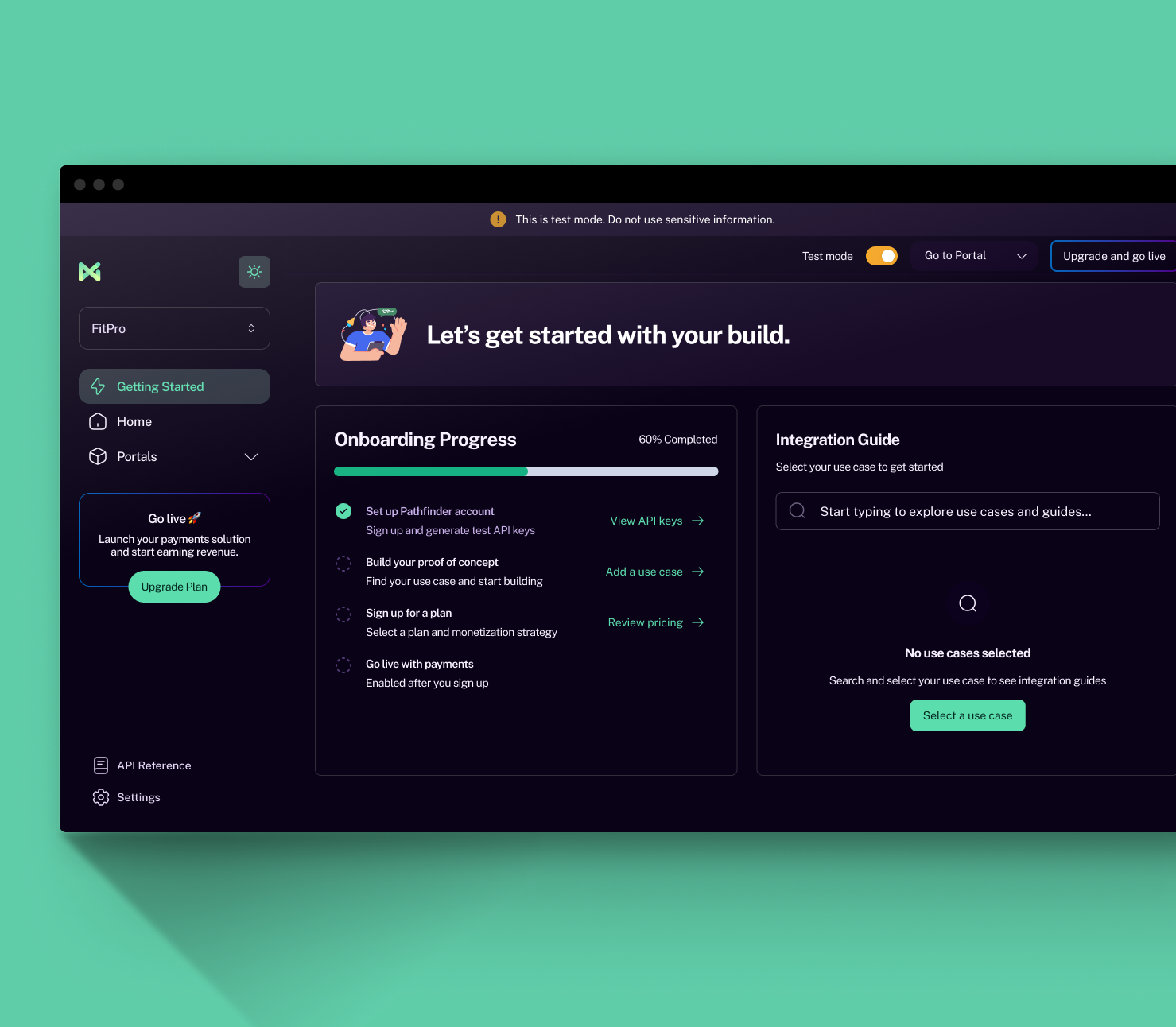

Accelerating payment integrations with test API keys and self sign-up

View project snapshot