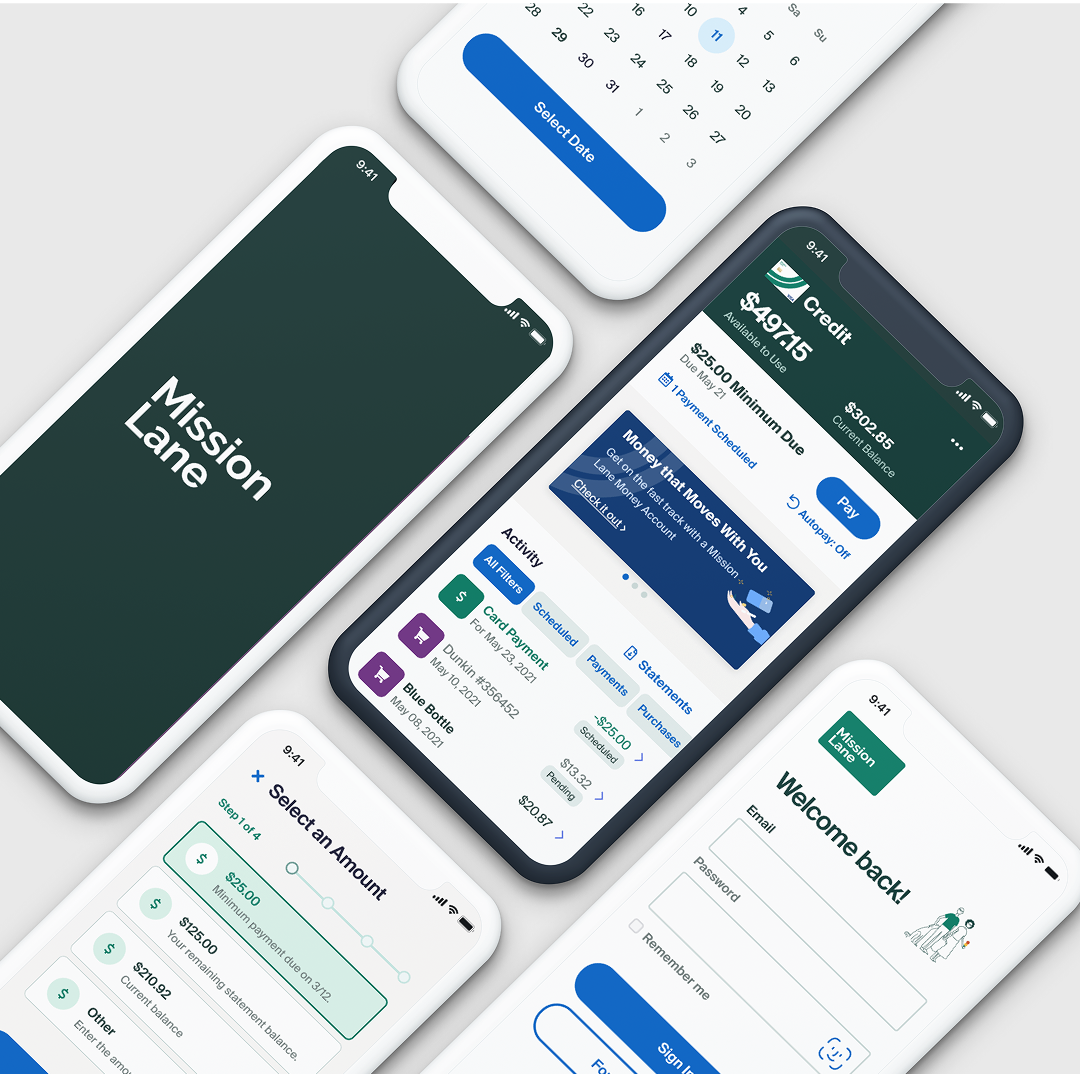

Redesign of Mission Lane's mobile app to improve repayment outcomes, customer sentiment and retention.

My role

Design Lead, Design Manager

My team

5 engineers, 2 Product Designers, Product Manager

App store rating (up from 2.8)

Improved repayment rates

Decreased support call volume

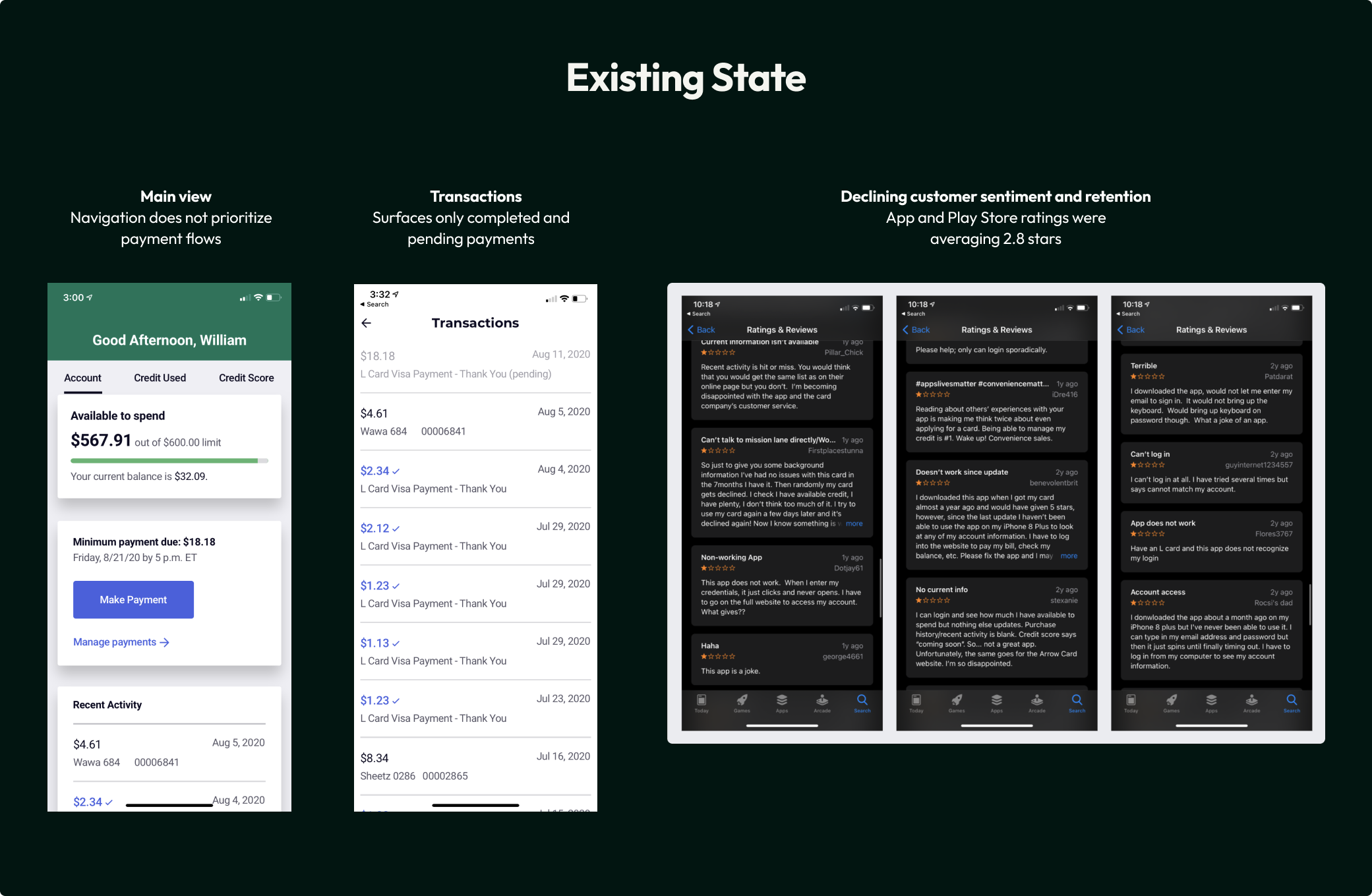

Mission Lane provides credit access to customers working to rebuild their credit. However, users lacked clear guidance on credit-building actions, like why paying more than the minimum, or the full statement balance, helps save on interest and improve credit utilization. The existing mobile app experience felt minimal and unhelpful, which contributed to low repayment rates, declining retention, and poor app store ratings.

"I only make the minimum payment because that's what the app says to do."

"I'm never sure if I have to do anything else after scheduling a payment."

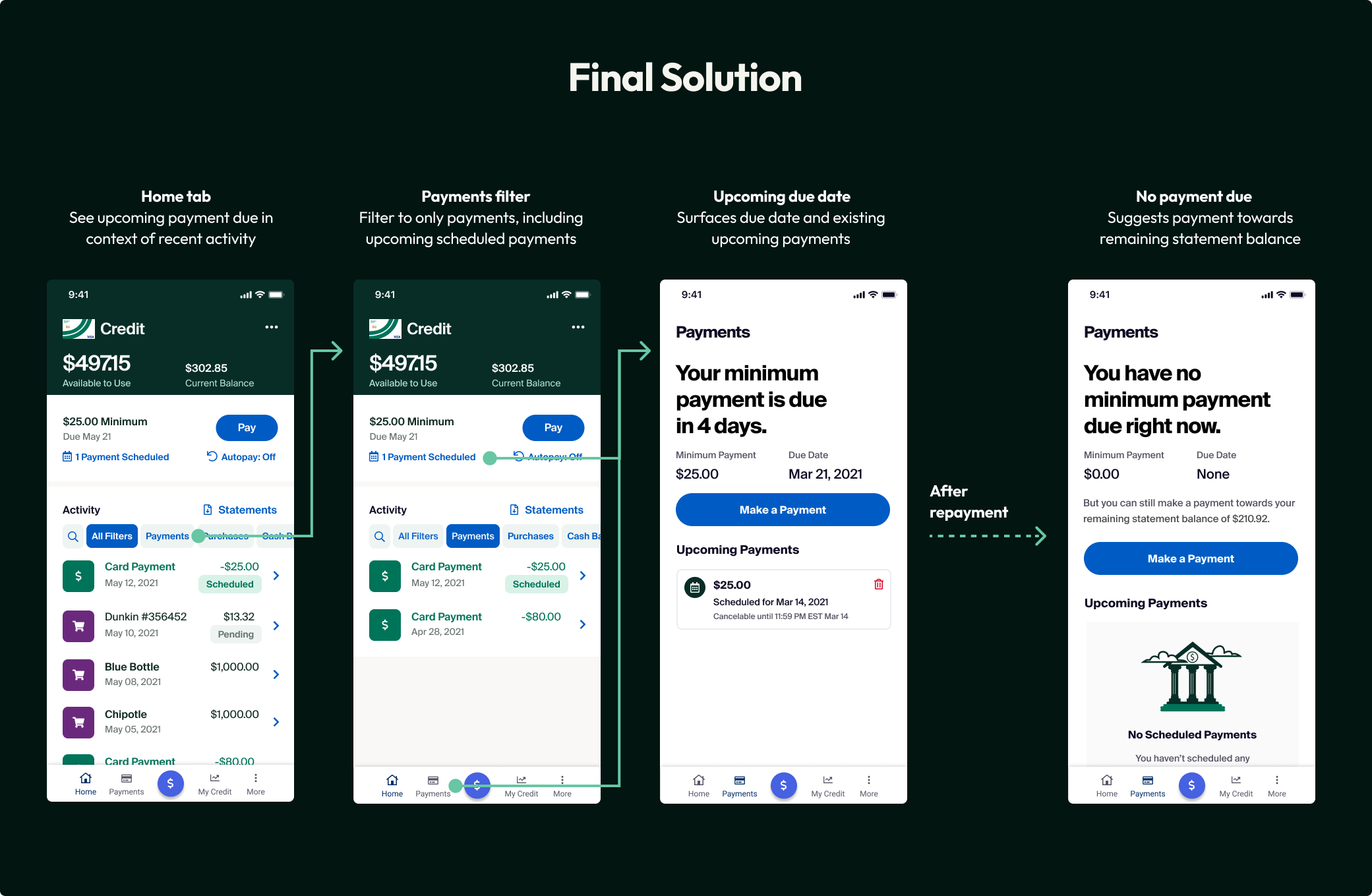

Through rapid prototyping and experimentation, we tested ways to guide customers toward the most beneficial actions—ones that helped them build credit and the business improve repayment outcomes. We found that users appreciated transparency around interest savings and preferred guidance and messaging over features like autopay.

"I don't do autopayments. I like to have some sort of control over how much I'm going to pay this month. I pay more than the minimum, but if it's a birthday month or I just bought some plane tickets, I might pay the minimum this month and use the money in a different way. I am worried about overdrawing."

"Creditors never have this information for you up front. It's great for people that's reckless with money. For creditors, they can say 'You can't say that I didn't tell you.'"

"Really like seeing what I'm saving… creditors like to keep you in debt because that's how they make money."

Based on these insights, we focused on clarifying payment messaging, ensuring the right guidance was obvious, easy, and possible depending on the state. I also recommended improving the information architecture and navigation to better support repayment flows as a primary task.

I led the restructure of the app experience, information architecture, navigation, and payment flows, with a focus on improving the clarity and transparency of repayment messaging.

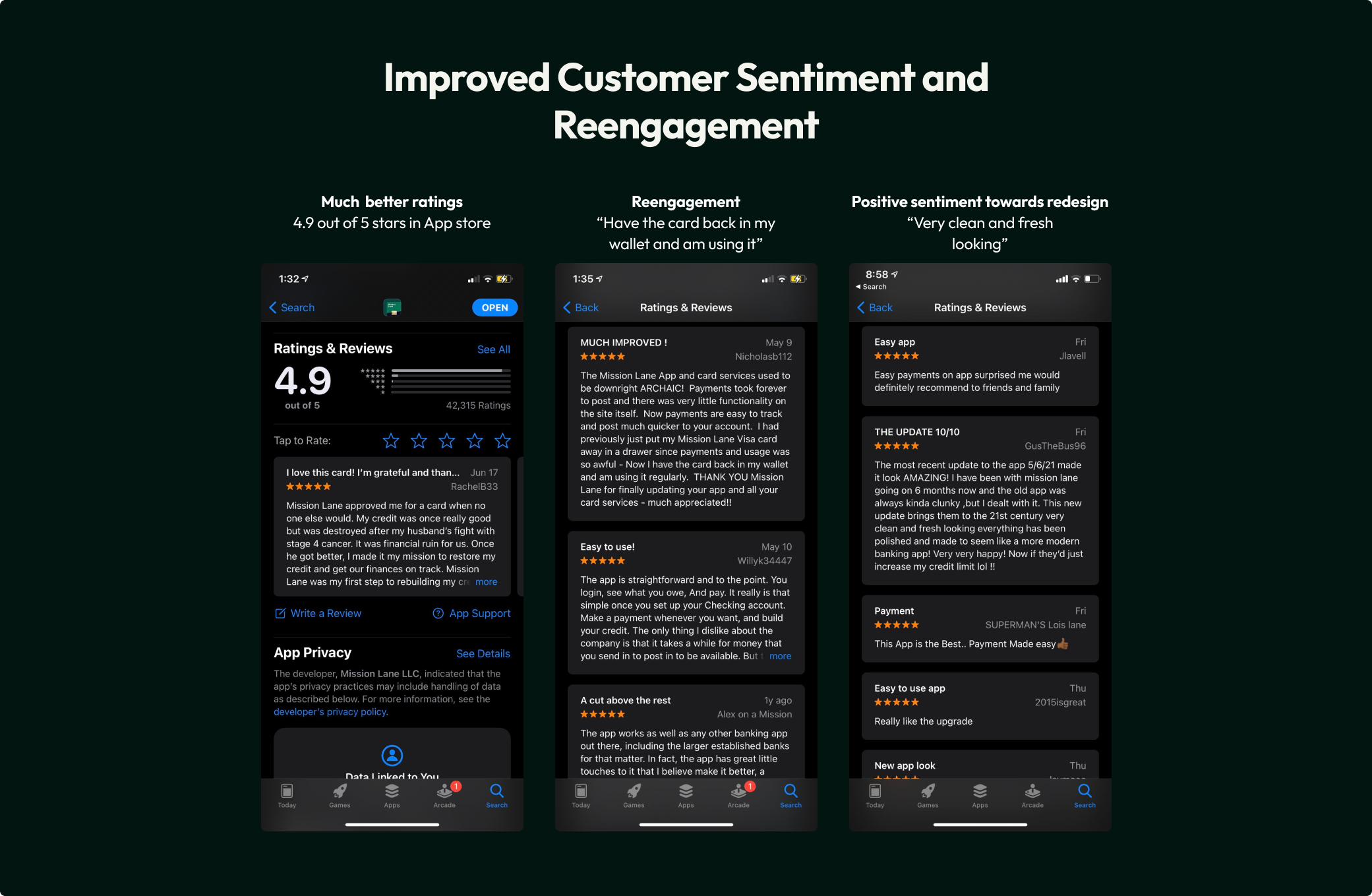

The redesigned experienced improved repayment rates, retention, customer sentiment and credit usage, while decreasing support call volume. We increased our average rating on the App and Play store from 2.8 to 4.9 stars.

"I had previously just put my Mission Lane Visa card away in a drawer since payments and usage was so awful. Now I have the card back in my wallet and am using it regularly. THANK YOU Mission Lane for finally updating your app and all your card services - much appreciated!!"

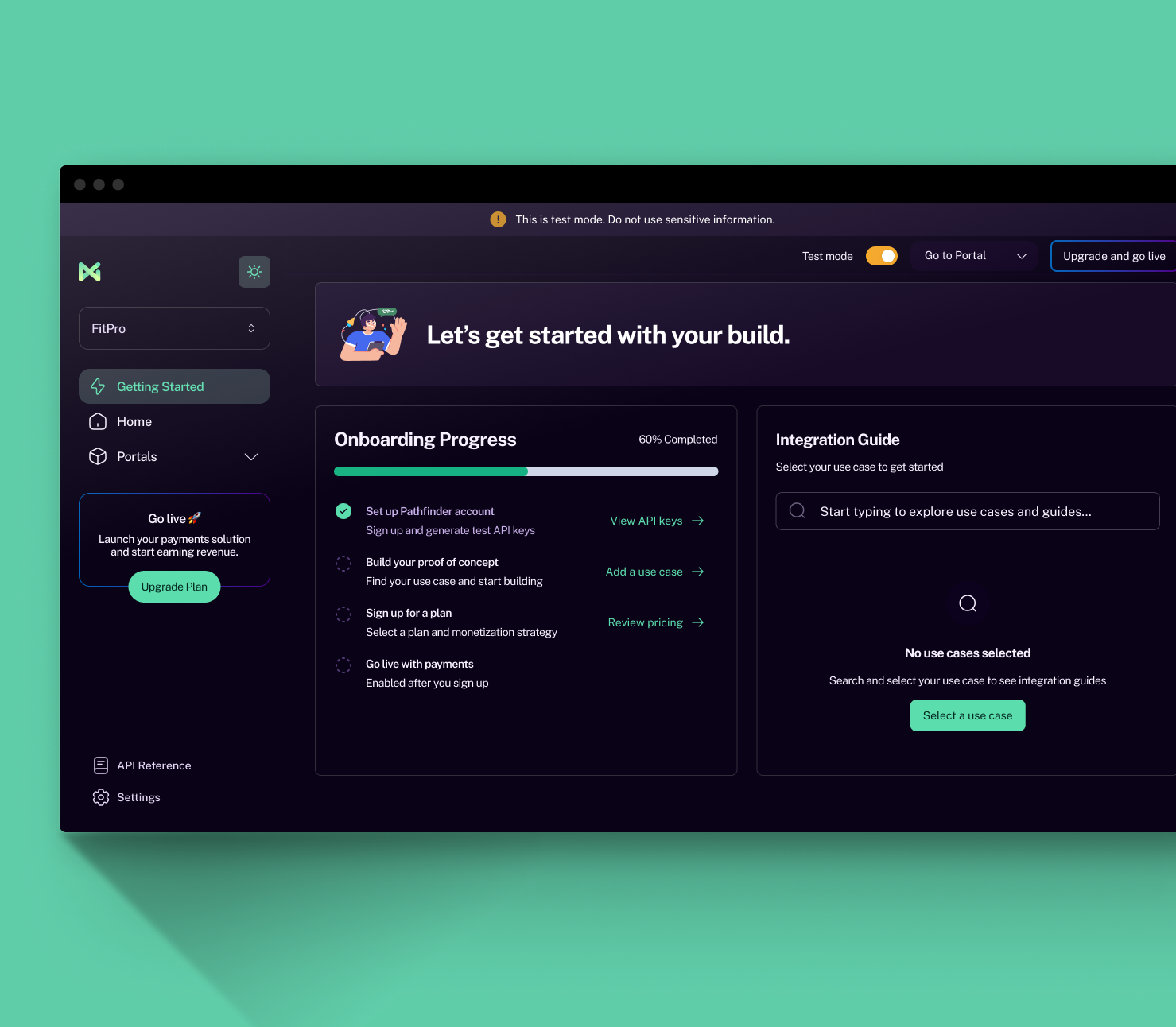

Accelerating payment integrations with test API keys and self sign-up

View project snapshot